federal income tax liabilities

The definition of tax liability is the amount of money or debt an individual or entity owes in taxes to the government. Youd be in the 10 tax bracket in 2022 and your income tax liability would be 1020 if youre single and you were to earn just 10200.

4 Steps To Determine How Much Your Business Will Owe In Taxes Projectionhub

Federal Personal Income Tax Liabilities and Payments 195997 By Thae S.

. Your income tax liability is determined by your. Federal income tax liability is the amount of tax you owe to the federal government on your annual earned income. Someones tax liability is the total.

Federal income tax liability is the amount of tax you owe to the federal government on your annual earned income. What is federal income tax liabilities. Your tax liability is computed for each tax bracket up to the one youre in.

For income tax purposes an LLC with only one member is treated as an entity disregarded as separate from its owner unless it files Form 8832 and elects to be treated as a. Means with respect to the June 30 2011 taxable year the sum of the A-Marks Federal Tax liability and any interest penalties and other additions to such. Your income tax liability is determined by your earnings and filing status.

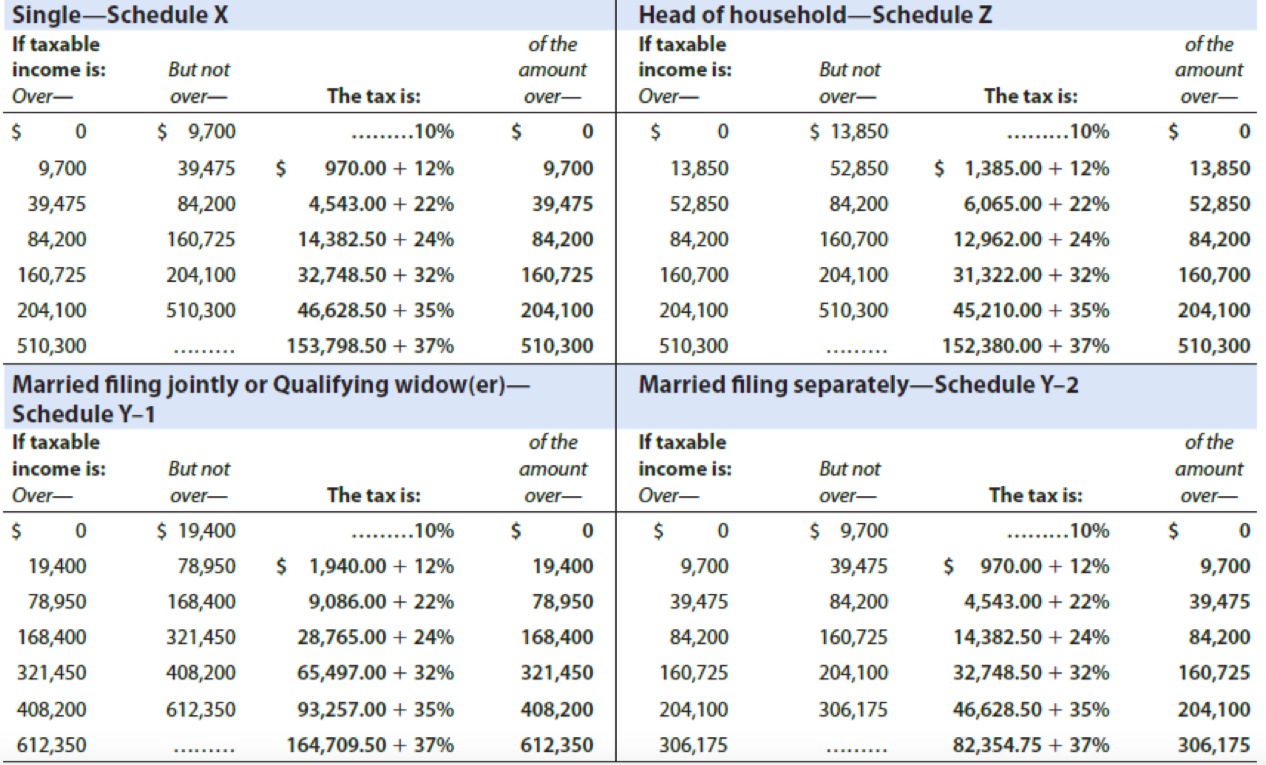

In general when people refer to. Taxable gross annual income subject to personal rates W-2 unearnedinvestment business income not eligible for 20 exemption amount etc Traditional IRA Contribution. Federal Income Tax Return Calculator Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

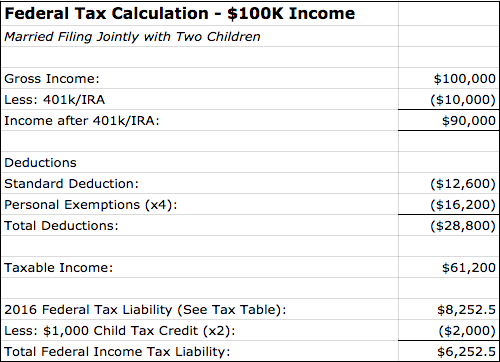

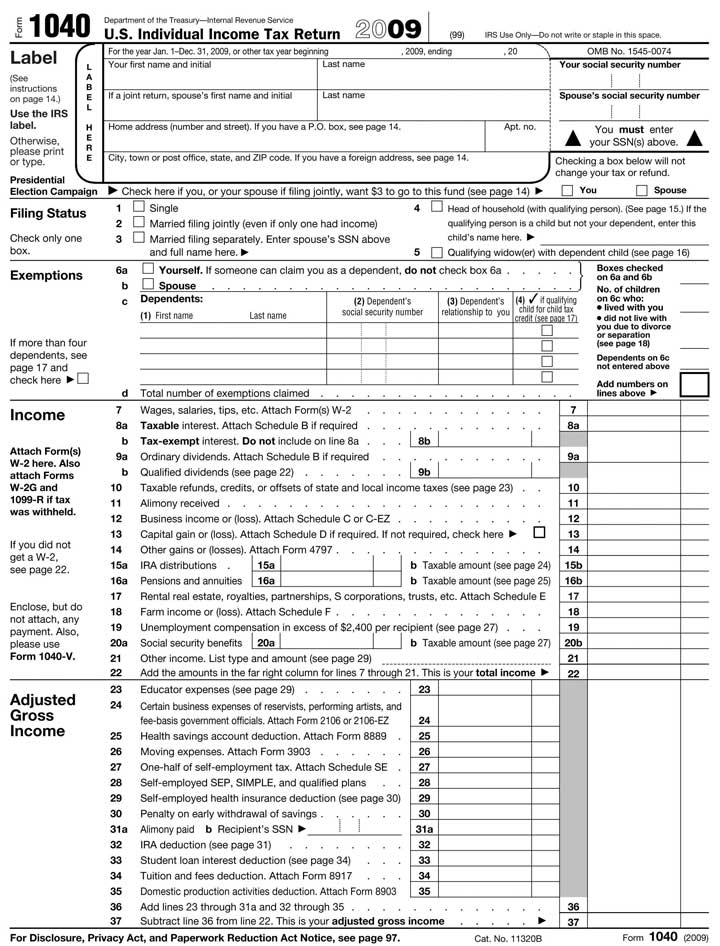

Your tax liability is the amount of taxes you owe to the IRS or your state government. 320000 27300 292700 205500 755988 2081178 2749176 5791842 John and Sarahs total federal. The definition of tax liability is the money you owe in taxes to the government.

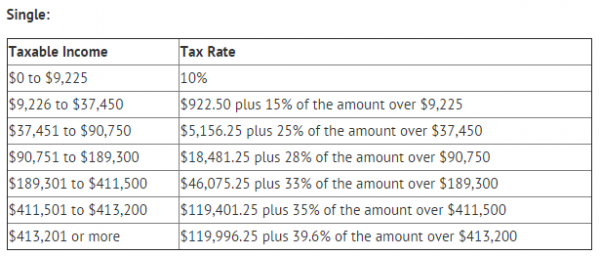

Your household income location filing status and number of personal. Your tax liability is the amount of taxes you owe to the IRS or your state government. There are seven federal tax brackets for the 2022 tax year.

This article presents estimates of Federal personal income tax liabilities and estimates of Federal. They would calculate their federal income tax liability as follows. In general when people refer to this term theyre.

These are the rates for. -A federal tax is imposed on policies issued by foreign insurers section 4371. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Your first 10275 is taxed at 10 so you owe 10275 x 10 1028 The. Tax Liability Definition. Depending on your income you may or may not.

What is federal income tax liabilities. Depending on your income you may or may not. This dual tax imposition and tax liability pattern is followed over and over again in federal tax law.

You would be pushed up into a 24. Define A-Xxxx Federal Tax Liability. Means income Taxes imposed on Safety or for which Safety may otherwise be liable i relating to US.

10 12 22 24 32 35 and 37. Tax liability is a tax term used by the Internal Revenue Service IRS and tax professionals when referring to someones tax responsibility. Heres how it works.

Your bracket depends on your taxable income and filing status. Define Federal and Consolidated Income Tax Liabilities.

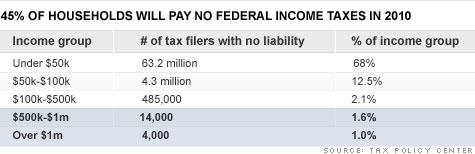

Millionaires Who Owe No Federal Income Tax May 9 2011

Federal Income Tax Outline Spring 2021 Federal Income Tax Spring 2021 Part Ii Is It Income Studocu

How The Tcja Tax Law Affects Your Personal Finances

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

54 Million Federal Tax Returns Had No Income Tax Liability In 2011 Tax Foundation

How A Family Of Four With A 0 000 Yearly Income Pays Only 252 In Federal Income Tax Richmondsavers Com

57 Of U S Households Paid No Federal Income Tax In 2021 Study

2021 Federal Income Tax Calculator Form 1040 Estimated Tax Liability

Federal Income Tax Liability In 2018 What Does That Mean I M Having A Really Hard Time Figuring Out What Numbers To Put In What Boxes

Understanding Your Tax Liability Smartasset

The Great Irs Hoax Why We Don T Owe Income Tax

Why Most Elderly Pay No Federal Tax Squared Away Blog

Solved Compute The 2019 Federal Income Tax Liability And The Chegg Com

The U S Federal Income Tax Process

Resolving Federal Tax Liabilities

Amendment To The Federal Income Tax Sharing Agreement Between Ameriprise Certificate Co Business Contracts Justia

How A Billionaire Pays 0 In Federal Income Tax By Kr Franklin Datadriveninvestor

Summary Of The Latest Federal Income Tax Data Tax Foundation

California Tax Expenditure Proposals Income Tax Introduction